Empowering a Sustainable Future with Solar Energy

At Roy Marketing House, we believe in creating a cleaner and greener planet through reliable solar energy solutions. With years of experience in solar technology, we provide high-quality solar panels and complete installation services for homes, businesses, and industries.

- Dedicated team of environmental experts and engineers

- 100% commitment to sustainability

- Expert-driven, custom solar and energy solutions

- Transparent practices and measurable impact

Roy Marketing House Solar Services

Solar Ongrids

Solar Ongrid Systems provide efficient power directly from sunlight, reducing electricity bills smartly.

More DetailsSolar Offgrid

Solar Offgrid Systems store energy in batteries, ensuring uninterrupted power even without electricity.

More DetailsSolar Hybrid

Solar Hybrid Systems combine ongrid and offgrid features for reliable, continuous, and efficient power

More DetailsSolar Water Pump

Solar Water Pumps use solar energy to draw water efficiently, ideal for farms, gardens, and remote areas.

More DetailsSolar Water Heater

Solar Water Heaters use sunlight to heat water efficiently, saving energy and reducing electricity costs.

More DetailsEV Charger

EV Chargers powered by solar energy offer fast, eco-friendly vehicle charging for homes and businesses.

More Details

Latest Projects, Solutions

And Energy Supplies

What our clients reviews

Calculate Your Savings

Explore the Potential of Solar Energy and Start Saving From Day 1!

System Size

Space Required

Annual Energy Generated

Annual Savings

Price (Excluding Subsidy & GST)

Subsidy

Project cost: ₹ 0

Down payment: ₹ 0

Loan Amount: ₹ 0

| Tenure (Months) | EMI (₹) |

|---|

Viverra Mauris In

Semper Viverra” 4.8*

Have a Question? we’ve

got The answers you need

A solar panel converts sunlight into electricity using photovoltaic cells, providing clean and renewable energy.

You can save up to 60–80% on your electricity bills depending on your usage and system size.

Yes, solar panels still generate power from indirect sunlight, though efficiency may be slightly reduced.

Quality solar panels last 25–30 years with minimal maintenance, ensuring long-term energy benefits.

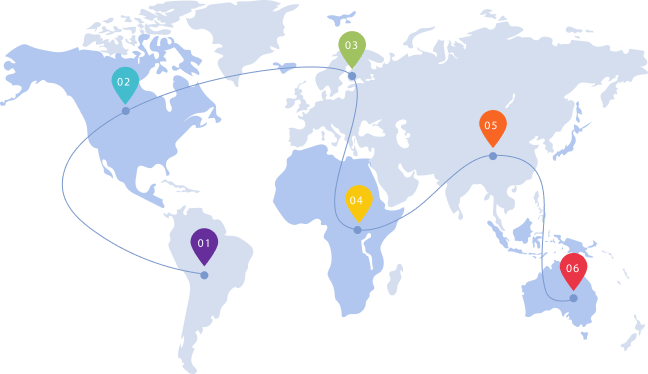

Express in the world

ofRoy Marketing House energy.

Environmentally Friendly

Our solar systems are environmentally friendly, reducing carbon emissions and promoting a cleaner, greener planet.

Low Maintenance

Our solar systems require low maintenance, ensuring long-lasting performance with minimal effort and cost.